Donation Receipts

Insight for Living Ministries sends receipts via postal mail that contain year-to-date donation information. They are beneficial to both the individuals who make contributions to your nonprofits and your organization itself.

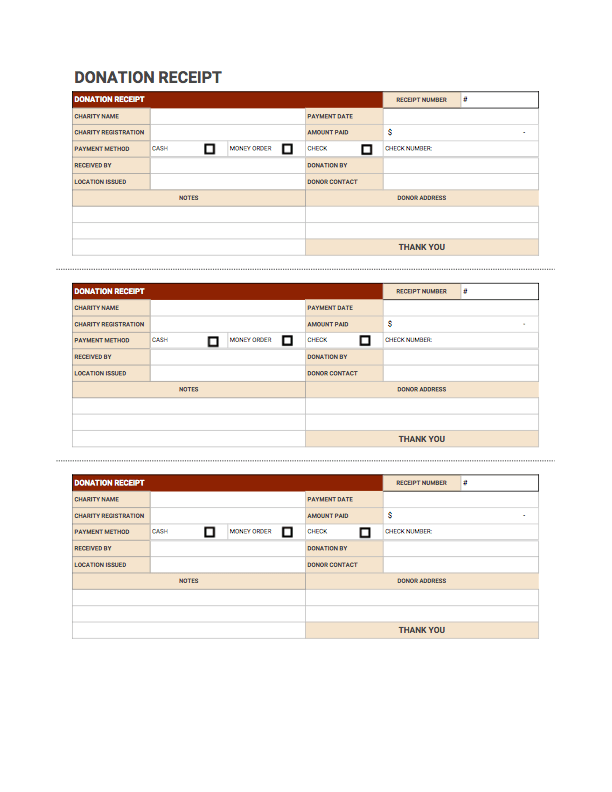

Donation Receipt Template Download Printable Pdf Templateroller

No goods or services can be traded for the donation amount in order for it to be tax.

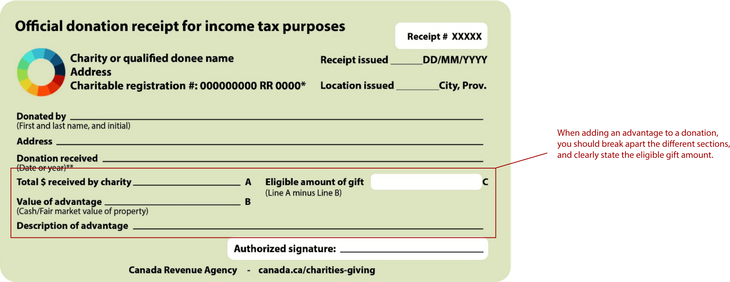

. Ad Easily Create Donation Pages Using a Powerful Fundraising Plugin. Start for free today. Official donation receipts must include the name and website address of the Canada Revenue Agency.

Details about the type of gift. A donation receipt is an official document that provides evidence of donations or gifts given to an organization by donors. A donation receipt is proof that a donor made a monetary or in-kind contribution to an organization.

Donation receipts are written acknowledgments that prove a charitable donation was made. Register today and start generating receipts online from anywhere anytime. Second you want to use your receipt as an additional donor touch that helps build a stronger relationship between you and your donor.

Schedule Your Free Home Pickup Today We have multiple ways to schedule your free donation pickup. It acknowledges that a gift was made to you and that the receipt contains the information required under the Income Tax Regulations. Add the donors name address phone number and email address etc.

Our system will give you all compliance report for legal filings. These notes serve as an acknowledgement that the gift monetary or non-monetary was received by the nonprofit. Each receipt must have its own unique serial number.

Donation receipts can be used to help with bookkeeping and to keep track of a donors history with your organization. XXX The serial number of the receipt. Your receipt is the only record of your tax deductible donation.

No goods or services were exchanged for this donation. For information on donating to charities visit wwwirsgov. Your final December receipt will indicate your annual giving.

Sign the donation receipt. Call us to discuss your special donation needs today. Nonprofit donor receipts are written notes issued to a qualified donor after they have made a donation to an organization.

Free Donation Receipts. There are many organizations that you can donate to with just a click of your mouse. Add your logo in your favorite fonts and colors.

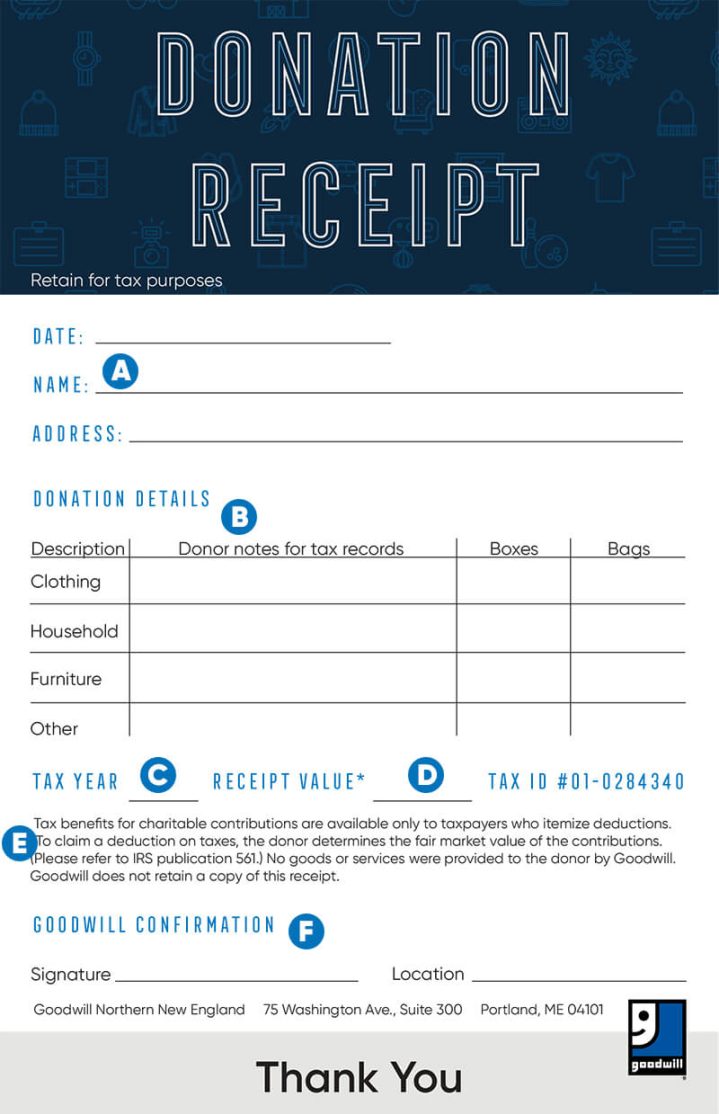

Donation Receipt Template 01. Still issuing manual donation receipt to donors. Goodwill SCWIs tax ID number is 39-114-7571.

In the US all types of registered 501 c 3 charitable organizations and registered 501 c non. Please note that it is the responsibility of the donor to determine fair market value of the items donated. A donation receipt should be issued for any monetary or in-kind donation made to your organization.

While sending a donation receipt is only necessary for gifts over 250 its advisable to send a separate receipt for each donation. The website address has changed to canadacacharities-giving. Name of the association.

Donations are mostly tax-deductible but taxpayers are not let off with just their word they need to provide proof that a particular amount of. Please keep your receipt for tax purposes and note that Goodwill SCWI does not retain a copy. Regardless of amount or type a 510 c3 organization must record every donation in order to keep its books compliant.

Charities and qualified donees have until March 31 2019 to update their receipts. No goods or services were provided to the donor by Goodwill of Southwestern Pennsylvania in exchange for this donation. Ad Our site shows when receipts are sent viewed by your customer and accepted or declined.

You can easily download free samples of the Donation Receipt Templates from this website. Add your non-profit organization name and basic contact details. Professional look and organization for small businesses.

They are often letters or emails sent to a supporter after a donation has been made. Further just type in the name of the organization and then follow the instructions given in the below sample in MS Word. The 4 Rules for Great Donation Receipts.

Add the donation amount. We pick up RAIN or SHINE. Ad Download or Email Form E201 More Fillable Forms Register and Subscribe Now.

Download the free Donation Receipt Template from Invoice Quickly. A statement that identifies the form as an official donation receipt for income tax purposes. Thank you for your donation.

We can work with our dispatch team to try to accomodate your special donation needs. First you need to make sure the donor has a record of their donation that they can use at tax time. Remember your non-profit receipts have two primary purposes.

You can print andor email the receipt to donor. Our driver will pick up your donation and leave a tax deduction receipt for you. A charitable receipt may be in form of an email message letter or receipt form that informs the donor about the received payment.

Name of gift donor. Many nonprofits send receipts out by the end of the year the gift was given or. This legal receipt should include some of the basic information.

The official registration and financial information of Goodwill of Southwestern Pennsylvania may be. Join 100000 Causes accepting donations online using Give.

Nonprofit Donation Receipt Letter Template

An Outline Of Donation Receipts And The Tax Deduction Process Cascade Business News

Donation Receipt Free Downloadable Templates Invoice Simple

5 Donation Receipt Templates Free To Use For Any Charitable Gift Lovetoknow

Nonprofit Donation Receipts Everything You Need To Know

Free Donation Receipt Template 501 C 3 Word Pdf Eforms

Donation Receipt Template Pdf Templates Jotform

Free Goodwill Donation Receipt Template Pdf Eforms

How To Fill Out A Goodwill Donation Tax Receipt Goodwill Nne