Sample Donation Receipt For Non Profit

Maxwell or Dear Professor Philips. Sample 3 Vehicle Donation Receipt DONATION RECEIPT.

Free Donation Receipt Template 501 C 3 Word Pdf Eforms

A non-profit organization usually writes this type of donation letter to ask for donations from their mailing list.

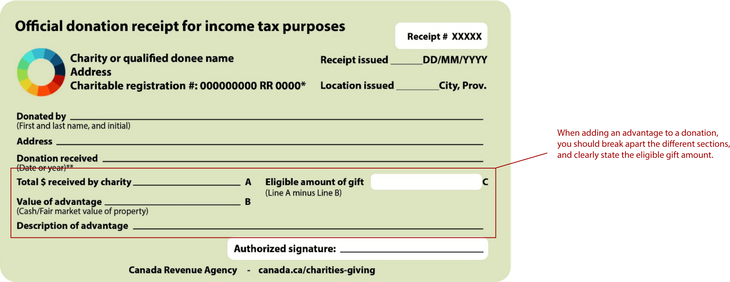

. You should use online donation request letters when youre running a campaign. However no matter the form every receipt must include six items to meet the standards set forth by the IRS. 34 First Street Gig Harbor WA 98332.

A statement that no goods or services were provided in return for the donation. The receipt can take a variety of written forms letters formal receipts postcards computer-generated forms etc. Eight Sample Fundraising Letters.

To Walter White The CEO Pearl Company Mumbai. By not issuing a donation receipt the donor is unable to claim the donation as a deductible and they may choose not to donate again. The short answer is simple.

Bill Smith 57 Main Street Townville MO 12345 Phone. So its advised to send out a donation receipt within 24-48 hours of the donation being made. A Microsoft receipt template is just the ticket.

Mychelle has a MSW in Social Service Administration and shes spent 20 years working in the non-profit sector. The donor estimates the value of non-cash contributions when reporting them to the IRS on his tax return. Use Excels classic blue sales receipt to provide detailed payment information to your customers.

Whatever the form every receipt must include six items to meet the standards set. MSW Social Service Administration. Pacific time on August 31 or your draft will be deleted.

Vehicle Donation Receipt Sample. The receipt used. Sample Local Donation Request Letter in PDF.

Charitable Donation Request Guidelines and. The statement On Publication 78 Data List. You may also see Character Reference Letters.

In the US it is required that an organization gives a donation receipt for any contribution that is 250 or more. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Please visit our State of Emergency Tax Relief page for additional information.

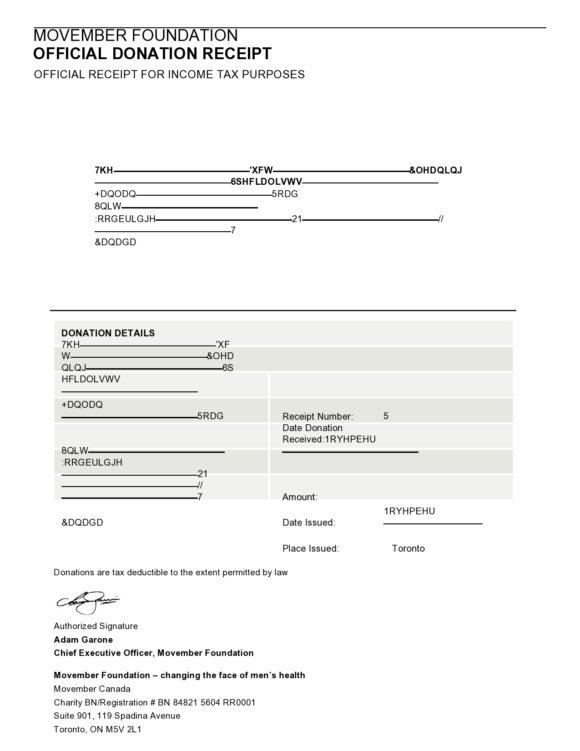

There are as many types of fundraising letters as there are fundraising projects and activities. Name of the Charity and Name of the Donor. Sample 501c3 Donation Receipt DONATION RECEIPT.

Box 0429 Townville MO 12345 Phone. This can be achieved by automating the process of issuing donation tax receipts more on this below. As such an online donation request letter is a fundraising letter that includes mention of an online campaign and provides the URL for the campaign.

It doesnt matter whether the donation to one organization reaches the 250. It can also be reported to an individual or organization like state institutions. If an organization writes a letter on behalf of an individual it will still be considered a corporate donation letter.

Updated June 03 2022. This gift was processed as credit card. Goodwill Industries of Northern New England.

Sample Donor Acknowledgement Letter for Cash Donation. With a template you can customize the perfect receipt for your organization. For help determining the value of goods being donated see the Salvation Armys Donation Value Guide.

Be sure that any letters you send are customized for your specific goals and written in a manner that is likely to be persuasive to the target audience. Its important to remember that without a written acknowledgment the donor cannot claim the tax deduction. Track company income and expenses with this twelve-month profit and loss statement template.

A donor is responsible for valuing the donated items and its important not to abuse or overvalue such items in the event of a tax audit. This letter can be used by a non-profit organization or a church to thank a person or persons who may have made a donation of food for the poor and the needy. Sample Church Fundraising Letters.

Online Services updates are scheduled for Wednesday August 31. There are many things you can do to make sure your receipt includes everything and still looks impressive. Free to Use for Any Charitable Gift.

This sales receipt offers formatted fields for taxes discounts unit prices subtotals and more. The receipt can take a variety of forms thank you note formal receipt postcard etc. On DATE you made a contribution of AMOUNT in support of our mission.

Single donations greater than 250. Each donor receipt should include the charitys name and name of the donor. The IRS requires donation receipts in certain situations.

5 Donation Receipt Templates. Requesting donation for free noon meal for students. A great way to achieve this is by downloading a template.

When Should You Use Them. Schools churches charities and non-profit organizations can follow the seven steps below to help guide their thoughts about what to write in an appreciation letter. Yes must be listed to confirm the entitys non-profit status.

With Sample By Mary Gormandy White. Also make sure that your template for the non-profit donation receipt is both professional and versatile. Make sure to send them out at the beginning of the campaign.

You should address a donor by their proper name and title. 1 Save The Goodwill Receipt Template. Businesses impacted by recent California fires may qualify for extensions tax relief and more.

This is an accessible template. From Joseph Sas Bloomsome Charity Mumbai. Get 247 customer support help when you place a homework help service order with us.

Name of the Non-Profit Organization. 2001 Kia Sedan 4D Blue. If you have a saved online draft application or renewal please submit it before 500 pm.

It also shows the donor that your organization appreciated the contribution of the donor. A Salvation Army donation receipt is used to report items at cash value when determining the tax-deductible value. The donation receipt template will be used to generate receipts with the factual information on upon receipt of a given donation.

501c3 Tax-Compliant Donation Receipt Requirements. A statement that no goods or services were provided by the organization if applicable A description and good faith estimate of the value of goods or services if any that the organization provided in return for the contribution. This letter gives them an idea of the right way to draft the content.

Name of the Non-Profit Organization. Donation receipt template are useful for charitable and non-profit making organizations who need to keep a record of the donations they have received. The Salvation Army being a 501c3 organization accepts almost anything of value even unused airline miles.

Start with a salutation. Learn about our Editorial Policy. Create a professional-looking profit and loss statement for personal use or self employment with ease using this profit and loss statement in Excel.

Yes you may still qualify for the charitable donations deduction without a donation receipt. Watch how expenses compare against gross profits with the line chart. Dear DONOR NAME Thank you for your generous donation to ORGANIZATION NAME a tax-exempt organization under Section 501c3 of the Internal Revenue Code EIN.

A Goodwill donation receipt is used to claim a tax deduction for clothing and household property that are itemized on an individuals taxes. The IRS considers each donation separately. Each printable receipts template is free customizable and works well in a variety of situations.

However there are certain specifications around the donation including cash limits and type of donation.

30 Non Profit Donation Receipt Templates Pdf Word Printabletemplates

Free Donation Receipt Templates Silent Partner Software

Free Donation Receipt Templates Silent Partner Software

Free Donation Receipt Templates Silent Partner Software

Nonprofit Donation Receipts Everything You Need To Know

Free Donation Receipt Template 501 C 3 Word Pdf Eforms

Non Profit Donation Receipt Template Using The Donation Receipt Template And Its Uses Donation Receipt Templ Donation Letter Receipt Template Donation Form